Disposable Income

Disposable Income 101

Disposable income refers to the amount of money that is left with you after paying direct taxes. In other words, disposable income means a household purchasing power. You can either consume or save disposable income. In general, people spend this type of income on necessities such as housing, clothing, and food.

Types of Disposable Income

There are two types of disposable income 1) Personal 2) National. The first one refers to the part of your personal income available for usage or disposable of a household. The second one is the total sum of all institutions and citizens’ income in the country.

In addition, Personal disposable income is available with an individual household or corporate business after they pay all sorts of tax obligations of the government. In contrast, National Disposable Income measures the income or cash available with the nation for either consumption or saving. It is important to know that this type of disposable income can also be either gross or net.

Advantages of Disposable Income

When it comes to the advantages of disposable income, you need to know that this has a huge impact on the stock market – for example, an increase in a company’s income leads to increased stock valuation and as a result of this, the value of the stock market raises. Another advantage is that if your income increases, you will have more money to spend or save and due to this, the consumption increases.

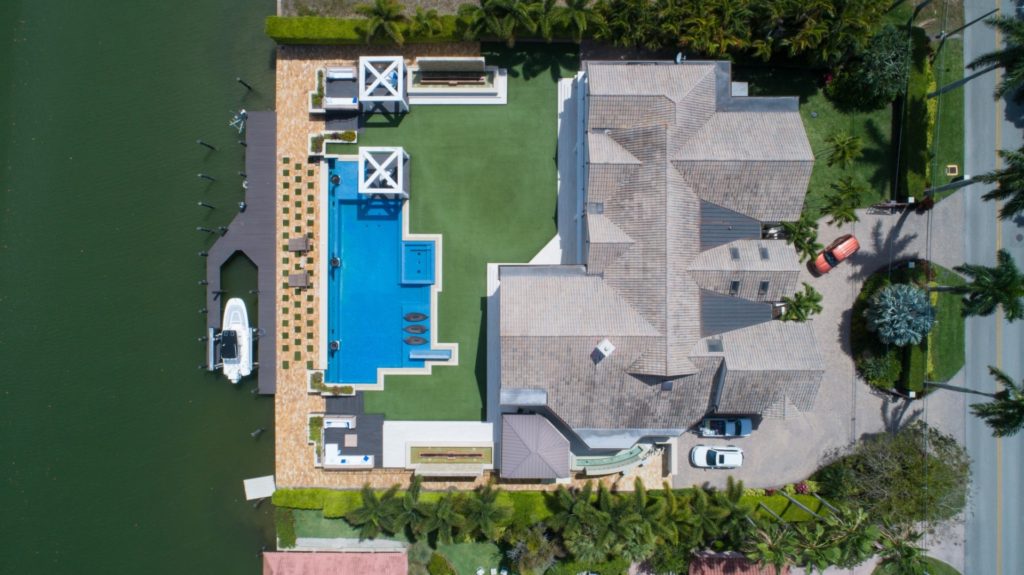

So much so, higher disposable income means purchasing luxury products, goods, or services. An increase in disposable income is a positive sign for all sorts of small businesses because their customers have money to purchase their goods and services.

Disposable income allows the finance ministry of a country to calculate the overall Gross and Net disposable income. Moreover, economic experts use it as a vital indicator to sustaining the economic wellbeing of the trade market.

Example of Disposable Income

We believe you have understood the concept of disposable income. However, with the following example, you will understand in a better way. Let’s say a family living in New York State with annual household incomes of $100,000. They paid 20% annual tax – what is the family’s disposable income? It is 20% of $100,000, which equals to $20,000. The disposable income in this case will be 100,000 – 20,000 = $80,000.

Uses of Disposable Income

There are many uses of disposable income. Primarily, it is useful for economic indicators and statistical measures. For instance, economists and financial statisticians use it as a starting point for measuring metrics like personal saving rates, discretionary income, as well as marginal propensity to consume and save.

People use disposable income to minus payments for important necessities such as health insurance, food, mortgage, and transportation. This likewise equals discretionary income. You can either save this portion of the disposable income or spend it on anything you want. Similarly, if you suffer from job loss or economic downturn or pay reduction, you can use the discretionary income to overcome the deteriorating financial situation.